Taxes off a paycheck calculation

Using the United States Tax Calculator is fairly simple. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck.

In Hand Salary Calculator Hot Sale 55 Off Www Ingeniovirtual Com

Total annual income Tax liability.

. Ad Payroll So Easy You Can Set It Up Run It Yourself. Let us know your questions. That means that your net pay will be 37957 per year or 3163 per month.

For example if you earn. How Your Paycheck Works. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Over 900000 Businesses Utilize Our Fast Easy Payroll. Next divide this number from the. Compare options to stop garnishment as soon as possible.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Learn About Payroll Tax Systems. Once you have worked out your tax liability you minus the money you put aside for tax withholdings every year if there is any.

Daily results based on a 5-day week Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the. How do I calculate hourly rate. That means that your net pay will be 43041 per year or 3587 per month.

All Services Backed by Tax Guarantee. If you make 55000 a year living in the region of New York USA you will be taxed 11959. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

How Do You Calculate Annual Income. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. Sign Up Today And Join The Team.

That means that your net pay will be 40568 per year or 3381 per month. Hourly Paycheck and Payroll Calculator. Ad Discover Helpful Information And Resources On Taxes From AARP.

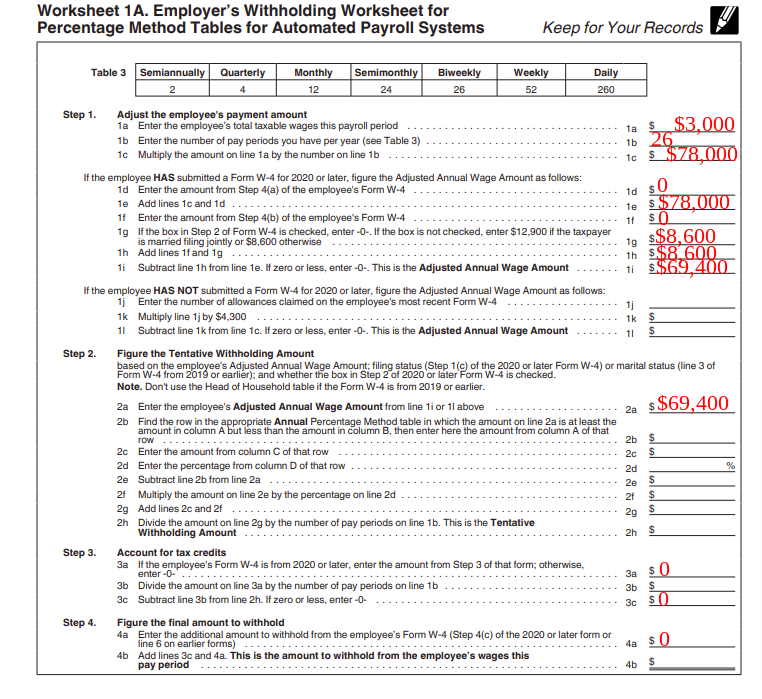

Learn About Payroll Tax Systems. First enter your Gross Salary amount where shown. This is tax withholding.

Ad Takes 2-5 minutes. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly. Estimate garnishment per pay period.

Need help calculating paychecks. Tax withholding is the money that comes out of your paycheck in order to pay taxes. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty.

Sign Up Today And Join The Team. Your average tax rate is. Thats where our paycheck calculator comes in.

Next select the Filing Status drop down menu and choose which option applies. Your average tax rate is. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

See how your withholding affects your. Over 900000 Businesses Utilize Our Fast Easy Payroll.

Paycheck Taxes Federal State Local Withholding H R Block

Payroll Tax What It Is How To Calculate It Bench Accounting

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Free Paycheck Calculator Cheap Sale 59 Off Www Ingeniovirtual Com

Indiana Paycheck Calculator Smartasset

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

How To Calculate Payroll Taxes Methods Examples More

Paycheck Calculator Us Apps On Google Play

Paycheck Calculator Us Apps On Google Play

How To Calculate Payroll Taxes Methods Examples More

In Hand Salary Calculator Hot Sale 55 Off Www Ingeniovirtual Com

How To Calculate Payroll Taxes Methods Examples More

Here S How Much Money You Take Home From A 75 000 Salary

New York Paycheck Calculator Smartasset

What Exactly Gets Taken Out Of Your Paycheck Tax Deductions Paycheck Payroll

Understanding Your Paycheck Credit Com